-

Persons obliged to submit the Declaration of Assets and Interests

Pursuant to Article 1 of Law no. 11/2003 (Legal Regime of Declaration of Assets and Interests) published on 28th July 2003, as amended by Law no. 1/2013 published on 21st January 2013, the persons obliged to submit the Declaration of Assets and Interests are divided into two groups:

1st Group Holders of Public Positions - The Chief Executive; - Principal officials, including the Secretaries, the Commissioner Against Corruption, the Commissioner of Audit, the Commissioner-General of the Unitary Police Service and the Director-General of the Macao Customs Service; - Members of the Legislative Assembly; - Judges and public prosecutors; - Members of the Executive Council; - Directorship, leadership and senior management officers of public services, including autonomous services and funds and other public legal persons, as well as chairpersons and members of boards of directors, administrators and supervisors thereof; - Holders of management and supervision positions of public corporations, corporations wholly or mainly public funded and concessionaires of public property; - The members of boards of directors on behalf of the Macao Special Administrative Region and delegates in representation of the Government; - Holders of other positions deemed equivalent to directorship, leadership and senior management officers, namely chiefs of cabinet and advisers. 2nd Group Staff of the Public Administration, including autonomous services and funds and other public legal persons - Public servants with permanent tenure or on fixed-term appointments; - Public servants in a probationary period or non-permanent personnel employed on temporary contracts; - Staff in short-term contracts (subordinate relation)1; - Civilian or militarised staff of the Public Security Forces of Macao; - Staff of the Customs Service. The above law also stipulates that Part IV of the Declaration of Assets and Interests of the following persons shall be publicly disclosed: - The Chief Executive; - Principal officials, including the Secretaries, the Commissioner Against Corruption, the Commissioner of Audit, the Commissioner-General of the Unitary Police Service and the Director-General of the Macao Customs Service; - Members of the Legislative Assembly; - Judges and public prosecutors; - Members of the Executive Council; - Chiefs of cabinet; - Directors and Deputy Directors of public services or holders of positions deemed equivalent to those, including autonomous services and funds and other public legal persons, as well as chairpersons and members of boards of directors, administrators and supervisors thereof; - Holders of management and supervision positions of public corporations, corporations wholly or mainly public funded and concessionaires of public property. Note 1: Including staff hired by a short-term employment or labour contract; those hired for specific tasks or for services rendered, as long as the relationship of subordination exists, will also be considered as staff of the Public Administration.

-

Place of submission

Note 2: Declarations of the following personnel are to be submitted to the Secretariat of the Court of Final Appeal: a) Staff of the Commission Against Corruption; b) Spouses or cohabiting partners, when both of them are obliged declarants and one of them must submit the declaration to the Secretariat of the Court of Final Appeal, irrespective of whether the declarations are made jointly or separately.

-

Form of the declaration and availability of the forms

- The declaration is to be made on the Declaration Forms prescribed by law consisting of four parts. If needed, the contents of Parts II through IV may be supplemented on the form named "Supplementary Information" or on supplementary documents. - Declaration forms are downloadable from the website of the CCAC (www.ccac.org.mo) or given out free of charge by the service or institution the declarant serves. The service or institution3 the declarant serves should provide the declarant, free of charge, with one set of the respective envelopes. If for any reason an extra envelope is needed, the cost is to be borne by the declarant. - Whenever the spouse or the cohabiting partner4 of the declarant is obliged to provide information, the relevant service or institution should also provide him/her, through the declarant, with one set of Parts I and II of the declaration forms and the respective envelopes. Note 3: It can also be its auxiliary department, the entity or service where the declarant takes up, holds or terminates his/her position, or its hierarchical superior. Note 4: The declarant's cohabiting partner must be unmarried and over 18 years of age who has been voluntarily living with the declarant in conditions similar to those of spouses for at least two years (Please refer to Articles 1471 and 1472 of the Civil Code).

-

When both spouses or cohabiting partners are holders of public positions or staff of the Public Administration

When both of them have to submit declarations at the same time

Joint declaration

If none of the declarants objects to access by the other to his/her own declaration contents, they may jointly submit one single declaration which includes all information to be declared and which both of them will sign in the capacity of declarants. On submission, the original will then be enclosed in the individual file of the first declarant while the photocopy will be inserted into that of the other.

Separate declaration If one of the declarants objects to access by the other to his/her own declaration contents, the declarants may submit their declarations separately. In such case, they only have to make and sign on their own respective declaration. Nonetheless, the declarant shall fill in the personal data of the spouse or of the cohabiting partner in Part I of his/her own declaration.

Two alternatives in separate declaration:

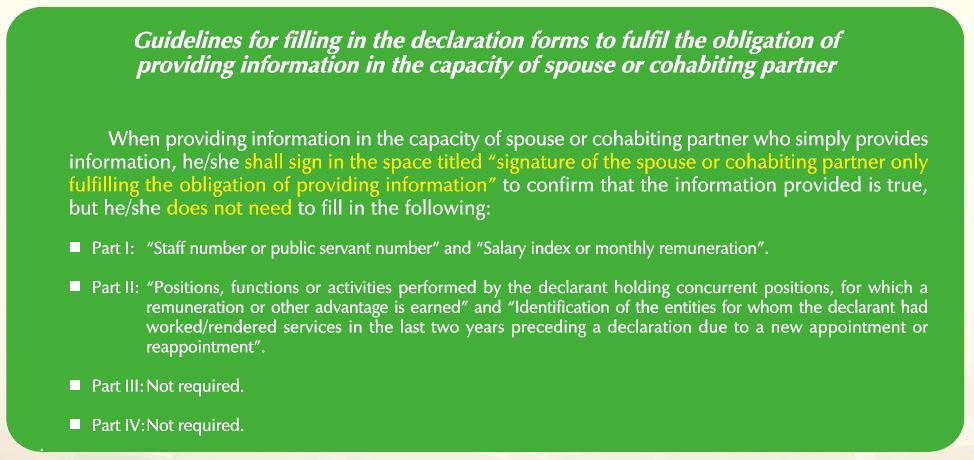

- Filling in one declaration: On submission, the declarant should inform the staff responsible for receiving declaration (hereinafter "the staff") that he/she is also obliged to provide information in the capacity of spouse or cohabiting partner. With assistance from the staff, the declarant will photocopy his/her own declaration. The original and the photocopy of the declaration will be enclosed in sealed envelopes and inserted into the individual files of the declarant and his/her spouse or cohabiting partner respectively. It should be noted, however, that either of the spouses, despite having access to his/her own individual file, is not entitled to retrieve the data submitted by his/her spouse. - Filling in two declarations: The declarant, in addition to submitting one complete set of the declaration to be enclosed in his/her individual file, shall also submit another set of Parts I and II of the declaration in order to fulfil the duty of providing information in the capacity of spouse or cohabiting partner, which is to be inserted into the individual file of his/her spouse (Please refer to "Guidelines for filling in the declaration forms to fulfil the obligation of providing information in the capacity of spouse or cohabiting partner"). When only one spouse is obliged to submit the declaration but the other one is not yet obliged to renew his/her own

Regardless of whether it is a joint or a separate declaration, the party who is not yet obliged to renew the declaration may choose to:

(1) Take the opportunity to renew his/her declaration in the capacity of declarant; or (2) Provide the required information for the declarant to complete the declaration, in the capacity of spouse or cohabiting partner (Please refer to "Guidelines for filling in the declaration forms to fulfil the obligation of providing information in the capacity of spouse or cohabiting partner"). ◆ What is the benefit of taking the opportunity to renew the declaration in the capacity of declarant? The main benefit is that it effectively renews the declaration. The future obligation to submit a declaration after the aforesaid five-year time limit will be counted from this renewal.

-

When the spouse or the cohabiting partner of the declarant is neither a holder of public position nor a staff of the Public Administration

✻ The spouse of the declarant is only obliged to provide the declarant with the information needed to fill in the declaration. ✻ The spouse may: - Provide adequate information to complete the declaration, either by filling it in him/herself or by transmitting the data to the declarant for him/her to fill in the form; or - Fill in Parts I and II of the declaration separately and submit them directly to the depositary entity.

(Please refer to "Guidelines for filling in the declaration forms to fulfil the obligation of providing information in the capacity of spouse or cohabiting partner")✻ The term for the spouse or cohabiting partner to submit the declaration is the same as that for the declarant, i.e. within 90 days from the day when the declarant becomes obliged to declare.

-

Duty to notify

The duty of the public entity or institution to notify the obliged declarant Within ten days from the day of the event from which the obligation of declaration originates, the service or institution the declarant serves (See note 3) shall: 1) Notify the declarant of his/her obligation by serving him/her with the notification letter prescribed by law; and, 2) Send copies of the notification letter to the two depositary entities simultaneously. If the service or institution fails to notify the declarant on time, it shall give notice of the failure to the two depositary entities within ten days. In case of termination of office due to death of the declarant, the service or institution shall, within ten days from the knowledge of the fact, inform the concerned depositary entity to proceed with the destruction of the declarations five years after the death of the declarant. The duty of the declarant to notify the spouse (when married) or the cohabiting partner Upon being notified of the obligation to submit a declaration, the declarant should as soon as possible notify the spouse or the cohabiting partner of the obligation to provide information.

-

General instructions for filling in the declaration forms

1. Before filling in the declaration forms, the declarant should read the guidelines carefully. 2. The declaration forms should be filled in with legible writing and the amounts should be denominated in Patacas or in other currencies. 3. The information may be typed in directly if an electronic form is used. 4. The declarant should initial each page of Part II of the declaration. 5. The declarant should initial each supplementary document. 6. The declarant should fill in the declaration forms carefully. 7. Pursuant to Article 27 of Law no. 11/2003 amended and republished by Law no. 1/2013, the declarant shall bear responsibility for inaccurate or false information. 8. All incomes, properties and liabilities in Macao or abroad should be listed in the declaration. 9. The date format shall be: "day/month/year". 10. Supplementary information may be filled in in the column "Remarks" if necessary.

-

Legal responsibility5

Legal responsibility of the declarant - Irregularities in formalities (Refer to Article 13 of the Legal Regime of Declaration of Assets and Interests)

- Whenever the depositary entity finds any irregularities in the formalities in the declaration, namely regarding the submission or the inadequate filling of Part I, the declarant shall be notified to make the required amendments within ten days upon receipt of the notification. Failure of the declarant to do so within the stated period shall be deemed as failure to submit the declaration, for which he/she shall bear the relevant responsibility. - Failure to submit the declaration within a designated period (Refer to Article 26 of the Legal Regime of Declaration of Assets and Interests)

- The declarant, who fails to submit the declaration within the designated period, incurs the suspension of one sixth of his/her salary or remuneration until the declaration is submitted. - The declarant, who fails to submit the declaration within the designated period due to his/her own fault, shall be liable to a fine equivalent to the triple of the monthly remuneration of his/her position. Notwithstanding the imposition of the fine, the suspension of one sixth of the remuneration shall continue until the declaration is submitted. - Failure of the declarant to abide by the order of the President of the Court of Final Appeal or the Commissioner Against Corruption, as applicable, to submit the declaration within the designated period (not exceeding 30 days) shall be deemed a crime of disobedience.- Inaccurate data (Refer to Articles 27 and 29 of the Legal Regime of Declaration of Assets and Interests)

- The inexcusable inaccuracy of the information provided by the declarant entails liability to a fine equivalent to three months to one year of the remuneration of the position held. - The declarant who provides inaccurate information with malicious intent shall be liable to imprisonment for up to three years or a fine for the crime of making false statement or declaration, as stipulated in Article 323 of the Penal Code. If a fine is imposed, the amount shall not be less than six months of the remuneration of the position held. Moreover, the declarant may be prohibited from being appointed to public office or performing public duties for up to ten years. - Unexplained wealth (Refer to Articles 28 and 29 of the Legal Regime of Declaration of Assets and Interests)

- The declarant who, directly or indirectly, is in possession of property or income abnormally exceeding the values declared and fails to explain how and when they have come to his/her ownership or to prove their lawful source, he/she shall be liable to imprisonment for up to three years or a fine. The unexplained property or income concerned may, by judicial order, be seized and transferred to the Macao SAR. Moreover, the declarant may be prohibited from being appointed to public office or performing public duties for up to ten years. Legal responsibility of the spouse or cohabiting partner of the declarant - Obligation to co-operate as spouse (Refer to Article 30 of the Legal Regime of Declaration of Assets and Interests)

- The spouse or cohabiting partner shall provide the required information for the declarant to fill in the declaration or submit Parts I and II to the depositary entity directly. Failure to fulfil this obligation with unjustifiable intent shall be punished with imprisonment for up to two years or a fine of up to 240 days. Note 5: More severe sanctions or special regimes specified in the Penal Code or other laws and regulations shall be enforced when applicable.

-

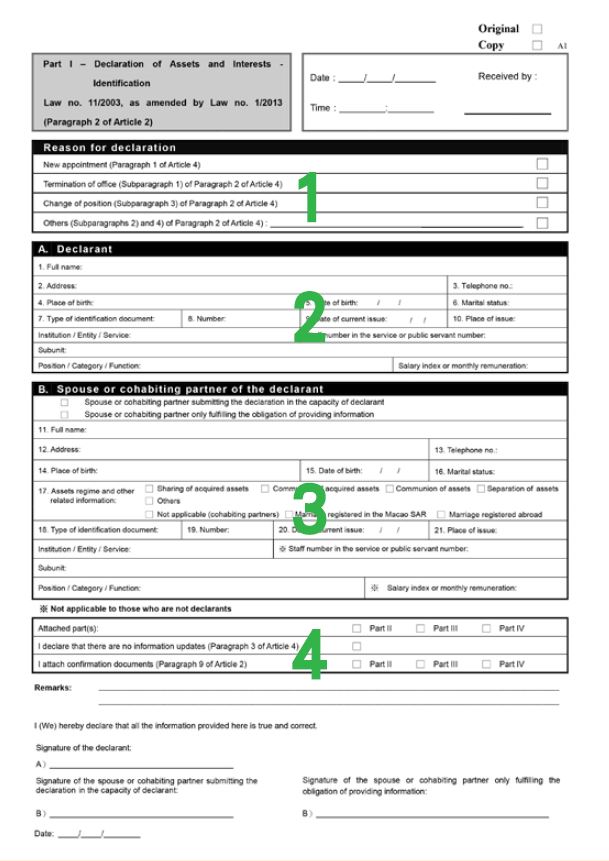

Part I - Declaration of Assets and Interests - Identification

This part is intended to be filled in with identification information of the declarant and the spouse or cohabiting partner.

1. Reason for declaration (1) New appointment The declaration shall be submitted within 90 days from the date when the declarant joins the public service for the first time, or resumes his/her duties in a new entity or institution. (2) Termination of office The declaration shall be renewed within 90 days from the date when the declarant retires, either voluntarily or compulsorily, has his/her service terminated for retirement, is removed from duty, terminates his/her contract, has the appointment terminated by his/her current department, is disciplined with dismissal (as disciplinary action) or initiates a long-term leave without pay. (3) Change of position The declaration shall be renewed within 90 days from the date when a change of department or public entity, a change of status and position, a change of salary or monthly remuneration of an amount exceeding or equal to 85 points of the salary index of the public service occurs. (4) Others If none of the above situations occurs within five years from the date of a declaration, that declaration shall be renewed within 90 days from the five-year time limit; for the holder of a public position, the declaration shall be renewed within 90 days from the date of reappointment, re-election or renewal of the term of office; whenever a spouse or cohabiting partner of a declarant renewing the declaration chooses to renew his/her own declaration, he/she shall renew the declaration within 90 days from the date of the related event; the declaration may be renewed on the declarant's own motion, for any other reasons. 2. Declarant 1. Full name Name as used in the identification document in Chinese, Portuguese or other languages. 2. Address Mailing address of the declarant in Chinese/Portuguese/English. 3. Telephone no. Current fixed-line number or mobile phone number of the declarant. 4. Place of birth Place of birth of the declarant. 5. Date of birth Date as stated in the identification document in the format of day/month/year. 6. Marital status Married, single, divorced or widowed. 7. Type of identification document E.g. Macao SAR Resident Identity Card or passport. 8. Number Number of the identification document. 9. Date of current issue Current issue date of the identification document. 10. Place of issue Region or country where the identification document was issued. Institution/Entity/Service - Entity or service in which the declarant works, e.g. bureau, office or committee. Subunit - The subunit in which the declarant works, e.g. department, division, sector or section. Position/Category/Function - Position of the declarant; if there is not a concrete name for the position, the type of appointment may be filled in. Staff number in the service or public servant number - The internal staff number as assigned by the service. For militarised staff, the officer number, commonly known as "badge number", may be used. Salary index or monthly remuneration - Salary index or monthly remuneration for the exercise of the respective functions. 3. Spouse or cohabiting partner of the declarant This part is not to be filled in by a declarant who is single, divorced or widowed and has no cohabiting partner. (1) Spouse or cohabiting partner submitting the declaration in the capacity of declarant: If the spouse of declarant A is also a public servant and submits the declaration in the capacity of declarant, the respective file will be updated as well. (2) Spouse or cohabiting partner only fulfiling the obligation of providing information: If the spouse of declarant A is not a public servant, he/she has the obligation to provide the required information to the declarant in order to fill in the declaration. If he/she is also a public servant and chooses to provide the required information to declarant A in order to fill in the declaration, his/her individual file will not be updated at the same time. 11. Full name Name as used in the identification document in Chinese, Portuguese or other languages. 12. Address Mailing address of the spouse in Chinese/Portuguese/English. 13. Telephone no. Current fixed-line number or mobile phone number of the spouse. 14. Place of birth Place of birth of the spouse. 15. Date of birth Date as stated in the identification document in the format of day/month/year. 16. Marital status Married, single, divorced or widowed. 17. Assets regime and other related information - The declarant must choose from the below assets regimes: sharing of acquired assets, communion of acquired assets, communion of assets, separation of assets; or others.

- For cohabiting partners there is no assets regime.

- If the marriage is registered in the Macao SAR, the assets regime shall be chosen among those listed above.

- If the marriage is registered abroad, whether or not to state the assets regime depends on its applicability to the declarant.

18. Type of identification document E.g. Macao SAR Resident Identity Card or passport. 19. Number Number of the identification document. 20. Date of current issue Current issue date of the identification document. 21. Place of issue Region or country where the identification document was issued. Institution/Entity/Service - Name of the institution, service or company in which the spouse works. Subunit - The subunit in which the spouse works, e.g. engineering department. Position/Category/Function - Name of position, e.g. engineer. ※Staff number in the service or public servant number - This field shall be filled in only when the spouse or cohabiting partner is also a public servant who submits the declaration in the capacity of declarant. ※Salary index or monthly remuneration - This field shall be filled in only when the spouse or cohabiting partner is also a public servant who submits the declaration in the capacity of declarant. 4. Description of other matters (1) Attached part(s) Tick the boxes for those parts that are attached to the declaration (Part II, III or IV). For renewal of the declaration, Part II shall again be filled in entirely with all the information subject to declaration. (2) I declare that there are no information updates (Paragraph 3 of Article 4) For renewal of the declaration, if there is not any change in the assets information previously declared, the declarant shall only tick this box and submit Part I of the declaration. It is not necessary to submit Part II, III or IV. (3) I attach confirmation documents (Paragraph 9 of Article 2) Tick the appropriate box for the part of the declaration (Part II, III or IV) to which the documents are attached. (4) Remarks Supplementary information may be filled in in the column "Remarks" if necessary. (5) Signature of the declarant The declarant shall sign to confirm that the information provided is true. (6) Signature of the spouse or cohabiting partner submitting the declaration in the capacity of declarant When the spouse of declarant A is also a public servant who submits the declaration in the capacity of declarant, he/she shall sign here to confirm that the information provided is true. (7) Signature of the spouse or cohabiting partner only fulfilling the obligation of providing information Regardless of whether the spouse of declarant A is a public servant or not, if he/she only submits the declaration for fulfilling the obligation of providing information, he/she shall sign here to confirm that the information provided is true. (8) Date Date of signing the declaration.

-

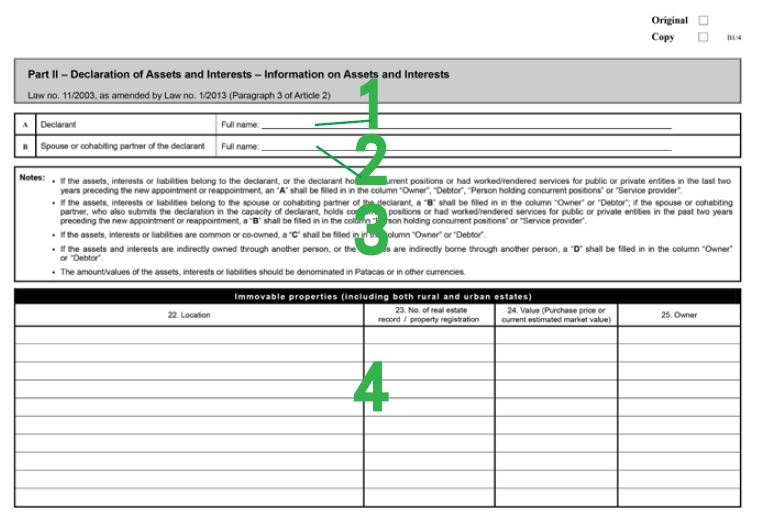

Part II - Declaration of Assets and Interests - Information on Assets and Interests

This part is intended to be filled in with information on the assets and interests of the declarant and the spouse or cohabiting partner.

1. Declarant Full name Name as used in the identification document in Chinese, Portuguese or other languages. 2. Spouse or cohabiting partner of the declarant Full name Name of the spouse or cohabiting partner as used in the identification document in Chinese, Portuguese or other languages. 3. Notes (1) The columns "Owner", "Debtor", "Person holding concurrent positions" or "Service provider" In the rightmost field of Part II, i.e. "Owner", "Debtor", "Person holding concurrent positions" and "Service provider", the declarant shall fill in "A", "B", "C" or "D" in accordance with the situations mentioned in Points 2 to 5 listed below (as per "Notes" in Part II of the declaration). (2) When to fill in "A" If the assets, interests or liabilities belong to the declarant, the declarant holds concurrent positions, or he/she had worked/rendered services for public or private entities in the last two years preceding the new appointment or reappointment, an "A" shall be filled in in the column "Owner", "Debtor", "Person holding concurrent positions" or "Service provider". (3) When to fill in "B" If the assets, interests or liabilities belong to the spouse or cohabiting partner of the declarant, a "B" shall be filled in in the column "Owner" or "Debtor"; if the spouse or cohabiting partner, who also submits the declaration in the capacity of declarant, holds concurrent positions or had worked/rendered services for public or private entities in the past two years preceding the new appointment or reappointment, a "B" shall be filled in in the column "Person holding concurrent positions" or "Service provider". (4) When to fill in "C" If the assets, interests or liabilities are common or co-owned, a "C" shall be filled in in the column "Owner" or "Debtor". (5) When to fill in "D" If the assets and interests are indirectly owned through another person, or the liabilities are indirectly borne through another person, a "D" shall be filled in in the column "Owner" or "Debtor". (6) Currency The amount/values of the assets, interests or liabilities should be denominated in Patacas or in other currencies. 4. Immovable properties (including both rural and urban estates) 22. Location The place and address where the immovable property is situated. If the property is located outside Macao, the country, city and address where the property is situated shall be indicated. 23. No. of real estate record/property registration For property in Macao, the "number of property record" shown on the property tax bill issued by the Financial Services Bureau is to be used. For property outside Macao, the number of the official document issued by the authority where the property is located is to be used. 24. Value (Purchase price or current estimated market value) The year of acquisition and the purchase price or the current estimated market value of the property. A remark must be made next to the value, stating whether it is a purchase price or an estimated value. 25. Owner Enter "A", "B", "C" or "D" in accordance with "Notes" in Part II of the declaration.

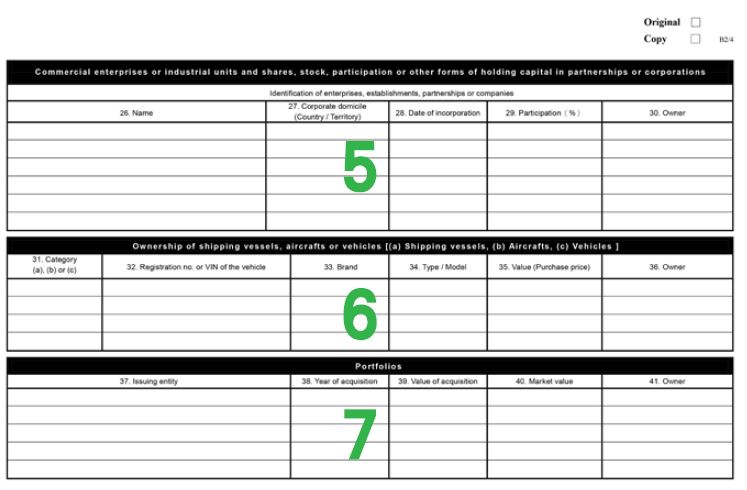

5. Commercial enterprises or industrial units and shares, stock, participation or other forms of holding capital in partnerships or corporations 26. Name Name or identification of the company. 27. Corporate domicile (Country/Territory) Location of the headquarters. 28. Date of incorporation Date of incorporation as per deed. 29. Participation (%) Percentage of capital owned. 30. Owner Fill in "A", "B", "C" or "D" in accordance with "Notes" in Part II of the declaration. 6. Ownership of shipping vessels, aircrafts or vehicles; [(a) Shipping vessels, (b) Aircrafts, (c) Vehicles 31. Category State the types of transport as follows: (a) Shipping vessels, (b) Aircrafts or (c) Vehicles. 32. Registration no. or VIN of the vehicle State the registration number which, for vehicles, may be the plate numbers or the VIN shown on the registration certificate. 33. Brand Brand as stated in the registration certificate. 34. Type / Model Type and model according to the description in the registration certificate. 35. Value (Purchase price) Purchase price of the shipping vessel, aircraft or vehicle. 36. Owner Fill in "A", "B", "C" or "D" in accordance with "Notes" in Part II of the declaration. 7. Portfolios This item includes shares, bonds, deeds or certificates of public debts, or any other negotiable instruments, regardless of whether or not they are listed or traded in a stock exchange. 37. Issuing entity Information of the entity that issues the instruments or the portfolios. 38. Year of acquisition The year in which the instruments or portfolios were purchased. 39. Value of acquisition The value at which the instruments or portfolios were purchased. 40. Market value The market value of the instruments or portfolios on the date of signing the declaration. 41. Owner Fill in "A", "B", "C" or "D" in accordance with "Notes" in Part II of the declaration.

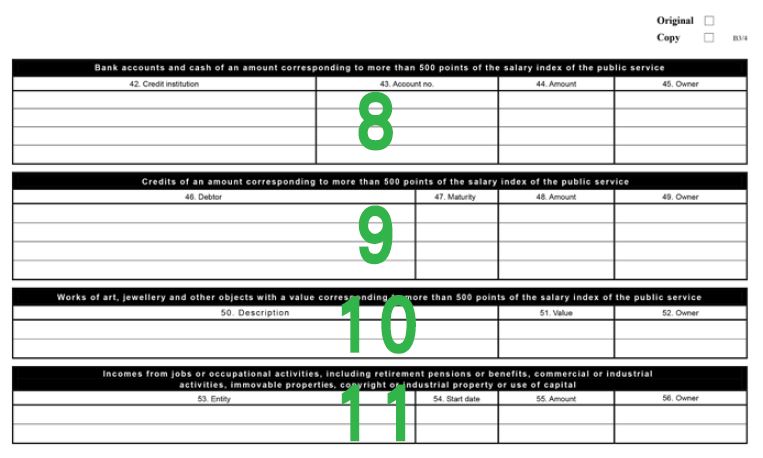

8. Bank accounts and cash of an amount corresponding to more than 500 points of the salary index of the public service Including deposits in any credit institution and cash kept in house, safe-deposit boxes in banks or other places of an amount corresponding to more than 500 points of the salary index. 42. Credit institution Banks, the Macao Postal Savings and financial leasing companies, etc. 43. Account no. Number of the account in the credit institution. 44. Amount Amount of the deposit or cash on the date of signing the declaration. 45. Owner Fill in "A", "B", "C" or "D" in accordance with "Notes" in Part II of the declaration. 9. Credits of an amount corresponding to more than 500 points of the salary index of the public service All credits of an amount corresponding to more than 500 points of the salary index should be declared, regardless of who the debtors are. 46. Debtor The identification of the debtor or other information to the same effect. 47. Maturity The maturity date of the credit. 48. Amount The amount owed by the debtor on the date of signing the declaration. 49. Owner Fill in "A", "B", "C" or "D" in accordance with "Notes" in Part II of the declaration. 10. Works of art, jewellery and other objects with a value corresponding to more than 500 points of the salary index of the public service Works of art, jewellery and other objects with a value corresponding to more than 500 points of the salary index shall be declared, such as furniture, audio-visual equipment and electrical appliances. However, consumable goods, such as alcoholic beverages and cigars, are excluded. For depreciable objects, their purchase price or market value on the date of the declaration may be filled in. 50. Description Clear and detailed description of the declared goods, e.g. a diamond ring. 51. Value Purchase value and the year of acquisition. The declarant may also refer to evaluations made by experts, official institutions or authoritative publications and may enclose relevant documents together with the declaration. 52. Owner Fill in "A", "B", "C" or "D" in accordance with "Notes" in Part II of the declaration. 11. Incomes from jobs or occupational activities, including retirement pensions or benefits, commercial or industrial activities, immovable properties, copyright or industrial property or use of capital Including all types of benefits or sources of income received by the declarant and his/her spouse or cohabiting partner. 53. Entity The identification of the entity from which the income is received or other information to the same effect, e.g. name of the institution or provider. 54. Start date The date on which the occupational activity started or the relevant income was received. 55. Amount The actual amount received from the engagement of the occupational activity, commercial or industrial activity, immovable property, copyright, industrial property or use of capital. If the activity is not carried out regularly or continuously, calculation shall be based on the period of the engagement only. 56. Owner Fill in "A", "B", "C" or "D" in accordance with "Notes" in Part II of the declaration.

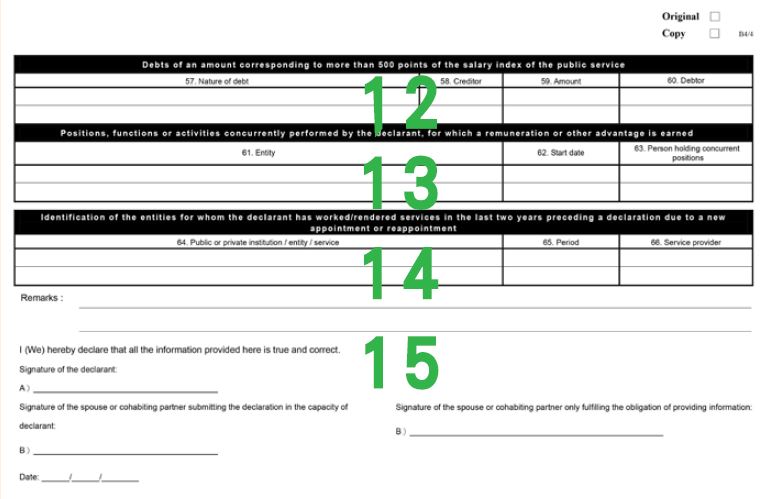

12. Debts of an amount corresponding to more than 500 points of the salary index of the public service Loans, mortgages, advance payments or other outstanding debts of an amount corresponding to more than 500 points of the salary index shall be declared, regardless of who the creditors are. 57. Nature of debt Brief description of the nature of the debt, e.g. mortgage. 58. Creditor Identification of the creditor, e.g. name of the individual or company. 59. Amount Outstanding amount on the date of signing the declaration. 60. Debtor Fill in "A", "B", "C" or "D" in accordance with "Notes" in Part II of the declaration. 13. Positions, functions or activities concurrently performed by the declarant, for which a remuneration or other advantage is earned Any other positions, functions or activities concurrently performed by the declarant, besides his/her public position, for which a remuneration or other advantage is earned, shall be declared regardless of whether or not they are of a public nature. 61. Entity Identification of position, function or activity concurrently performed by the declarant, e.g. name of the company or individual. 62. Start date The date on which the declarant began the position, function or activity. 63. Person holding concurrent positions Fill in "A" or "B" in accordance with "Notes" in Part II of the declaration. 14. Identification of the entities for whom the declarant had worked/rendered services in the last two years preceding a declaration due to a new appointment or reappointment 64. Public or private institution/entity/service Name of the public/private institution or individual for whom the declarant had worked/rendered services. 65. Period The period of service provided by the declarant to the related entity or individual. 66. Service provider Fill in "A" or "B" in accordance with "Notes" in Part II of the declaration. 15. Description of other matters (1) Remarks Supplementary information may be filled in in the column "Remarks" if necessary. (2) Signature of the declarant The declarant shall sign to confirm that the information provided is true. (3) Signature of the spouse or cohabiting partner submitting the declaration in the capacity of declarant When the spouse of declarant A is also a public servant who submits the declaration in the capacity of declarant, he/she shall sign here to confirm that the information provided is true. (4) Signature of the spouse or cohabiting partner only fulfilling the obligation of providing information Regardless of whether or not the spouse of declarant A being a public servant, if he/she only submits the declaration for fulfilling the obligation of providing information, he/she shall sign here to confirm that the information provided is true. (5) Date Date of signing the declaration.

-

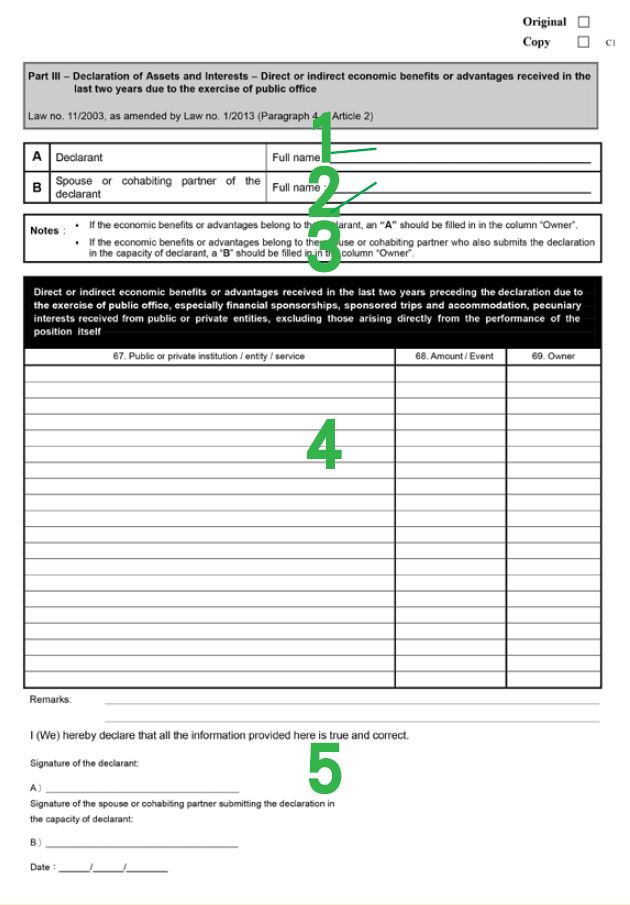

Part III - Declaration of Assets and Interests - Direct or indirect economic benefits or advantages received in the last two years due to the exercise of public office

1. Declarant Full name Name as used in the identification document in Chinese, Portuguese or other languages. 2. Spouse or cohabiting partner of the declarant Full name Name of the spouse or cohabiting partner as used in the identification document in Chinese, Portuguese or other languages.

3. Notes (1) The column "Owner" In the rightmost column "Owner" of Part III of the declaration, the declarant shall fill in "A" or "B" in accordance with the situations mentioned in Points 2 and 3 listed below (i.e. "Notes" in Part III of the declaration). (2) When to fill in "A" If the economic benefits or advantages belong to the declarant, an "A" should be filled in in the column "Owner". (3) When to fill in "B" If the economic benefits or advantages belong to the spouse or cohabiting partner who also submits the declaration in the capacity of declarant, a "B" should be filled in in the column "Owner". 4. Direct or indirect economic benefits or advantages received in the last two years preceding the declaration due to the exercise of public office, especially financial sponsorships, sponsored trips and accommodation, pecuniary interests received from public or private entities, excluding those arising directly from the performance of the position itself 67. Public or private institution/entity/service The public or private institution, entity, service or person from which the economic benefits or advantages were received. 68. Amount/Event Actual or estimated amount of such economic benefits or advantages. If the declarant cannot estimate the amount, the type of advantage should be specified, e.g. free hotel accommodation. 69. Owner Fill in "A" or "B" in accordance with the "Notes" in Part III of the declaration. 5. Description of other matters (1) Remarks Supplementary information may be filled in in the column "Remarks" if necessary. (2) Signature of the declarant The declarant shall sign to confirm that the information provided is true. (3) Signature of the spouse or cohabiting partner submitting the declaration in the capacity of declarant When the spouse of declarant A is also a public servant who submits the declaration in the capacity of declarant, he/she shall sign here to confirm that the information provided is true. (4) Date Date of signing the declaration.

-

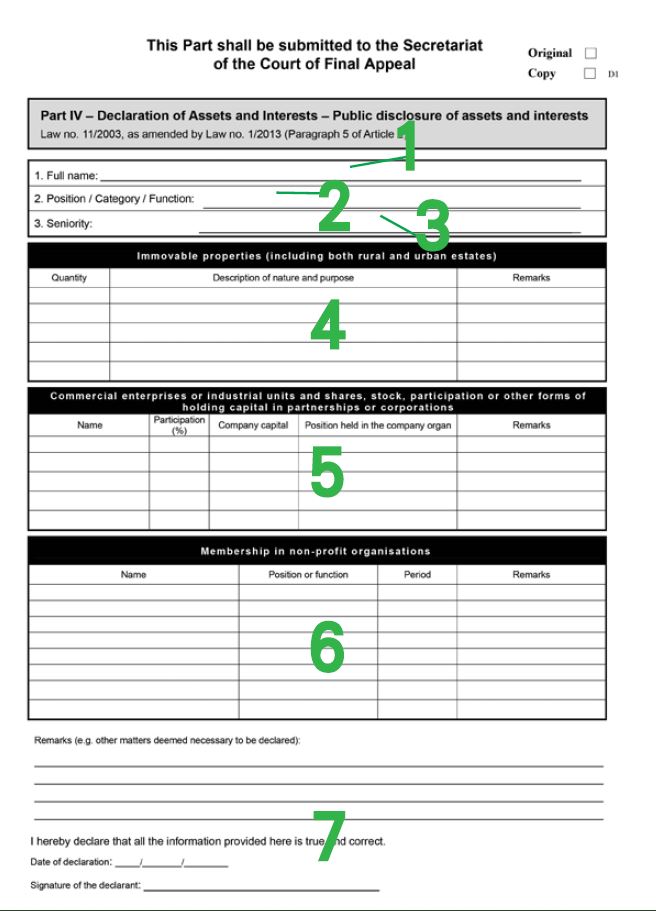

Part IV - Declaration of Assets and Interests - Public Disclosure of Assets and Interests

Persons who are obliged to publicly disclose the information on their assets and interests 1) The Chief Executive and principal officials 2) Members of the Legislative Assembly 3) Judges and public prosecutors; 4) Members of the Executive Council; 5) Chiefs of cabinet; 6) Directors and Deputy Directors of public services or holders of positions deemed equivalent to those, including autonomous services and funds and other public legal persons, as well as chairpersons and members of boards of directors, administrators and supervisors thereof; 7) Holders of management and supervision positions of public corporations, corporations wholly or mainly public funded and concessionaires of public property. 1. Full name Name as used in the identification document in Chinese, Portuguese or other languages. 2. Position/Category/Function The position held by the declarant. Examples: - Member of the Legislative Assembly / Member of the Executive Council / Chairman of the Board of Directors of ABC Co. Ltd.

- Director of the Environmental Protection Bureau

3. Seniority The total number of years working in both public and private sectors. 4. Immovable properties (including both rural and urban estates) (1) Quantity The declarant shall classify the immovable properties by nature and purpose and indicate the number of immovable properties of each category. (2) Nature and purpose of immovable property All immovable properties owned by the declarant must be declared irrespective of their nature and purpose. (3) Description of nature and purpose ◆ The nature of the immovable property shall be stated, e.g. land, factory, condominium (building) or condominium unit. ◆ Purpose Examples: - for residential use

- for industrial use

- for commercial use

- for services or freelance work or as offices

- for operating hotels or similar businesses

- as social facilities

- for vehicle parking*

Note: Please refer to Article 1 of Law no. 6/99/M of 17th December.

*Parking space The parking space shall be declared in Part IV provided that it is partitioned and with an independent deed and a concrete location (as per the property tax bill issued by the Financial Services Bureau). (4) Remarks Supplementary information may be filled in in the column "Remarks" if necessary. 5. Commercial enterprises or industrial units and shares, stock, participation or other forms of holding capital in partnerships or corporations (1) Name Name of the enterprise or company (based on the commercial registration). (2) Participation (%) Percentage of capital owned. Note: The shares/stock/participation to be declared are only those that are directly owned by the declarant (or his/her agent). If the company (e.g. Company A) owned by the declarant is a shareholder of other companies (e.g. Company B), neither this nor further nested participations shall be declared. (3) Company capital The registered capital as stated in the company charter. (4) Position held in the company organ The position held or the functions performed by the declarant in any company organ. (5) Remarks Supplementary information may be filled in in the column "Remarks" if necessary. 6. Membership in non-profit organisations (1) Name Registered name of the non-profit organisation. (2) Position or function The position held or function performed by the declarant in the stated organisation. All positions held in the non-profit organisations shall be declared, regardless of their titles Examples: - Honorary President or President Honoris Causa

- Founding President

(3) Period The period of service in the said organisation. Example: from 1995 to present.

(4) Remarks Supplementary information may be filled in in the column "Remarks" if necessary. 7. Others (1) Remarks (e.g. other matters deemed necessary to be declared) Supplementary information may be filled in in the column "Remarks" if necessary. (2) Date of declaration Date of signing the declaration. (3) Signature of the declarant The declarant shall sign to confirm that the information provided is true.

-

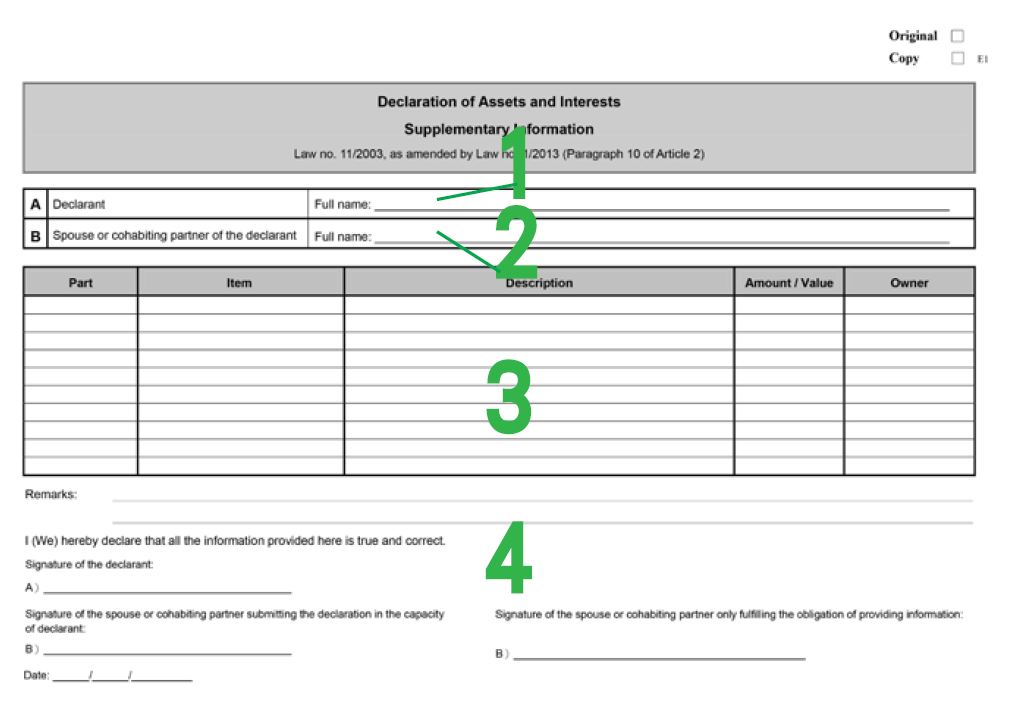

Declaration of Assets and Interests - Supplementary Information

This part may be used for supplementing in detail the contents of Parts II, III and IV. 1. Declarant Full name Name as used in the identification document in Chinese, Portuguese or other language. 2. Spouse or cohabiting partner of the declarant Full name Name of the spouse or cohabiting partner as used in the identification document in Chinese, Portuguese or other language. 3. Supplementary information (1) Part Indicate the relevant Part (Part II, III or IV) to which the item is relevant. (2) Item Indicate the item (e.g. bank accounts and cash). (3) Description This column should be filled in according to the instructions for the corresponding Part (e.g. for a bank account, the name of the credit institution and the account number shall be filled in in the column "Description"). (4) Amount/Value This column shall be filled in according to the instructions for the corresponding Part if applicable. (5) Owner This column shall be filled in according to the instructions for the corresponding Part. 4. Description of other matters (1) Remarks Supplementary information may be filled in in the column "Remarks" if necessary. (2) Signature of the declarant The declarant shall sign to confirm that the information provided is true. (3) Signature of the spouse or cohabiting partner submitting the declaration in the capacity of declarant When the spouse of declarant A is also a public servant who submits the declaration in the capacity of declarant, he/she shall sign here to confirm that the information provided is true. (4) Signature of the spouse or cohabiting partner only fulfilling the obligation of providing information Regardless of whether the spouse of declarant A being a public servant or not, if he/she only submits the declaration for fulfilling the obligation of providing information, he/she shall sign here to confirm that the information provided is true. (5) Date Date of signing the declaration.

-

Submission of declaration

To better protect the privacy of information on assets and to ensure the declaration is delivered to the depositary entity safely, it is recommended that the declaration be submitted in person.

Important notice regarding the submission of declaration

1. To ensure a speedy submission, the declarant should fill in the declaration forms properly before submission. When the spouses submit their declarations jointly, it is important to make sure that the respective parts are signed by both of them. 2. In addition to filling in the declaration, the declarant shall also write his/her name and position on the respective envelopes and put an "x" or a "✓" in the appropriate box to indicate the reason of this declaration: ■"New appointment" - when the declarant joins the public service for the first time, or resumes his/her duties in a new entity or institution (including the resumption of original public duties after leave without pay). ■"Termination of office" - voluntary or compulsory retirement, termination of service for retirement, removal from duty, termination of contract, termination of appointment by the current department, dismissal (as disciplinary action) or long-term leave without pay. ■"Change of position" - change of entity or service, change of status and position, or change of salary or monthly remuneration of an amount exceeding or equal to 85 points of the salary index of the public service. ■"Others" - other situations which are left unspecified above, such as compulsory renewal every five years or voluntary renewal. The declarant shall put an "x" or a "✓" in the appropriate box to indicate the place of submission. 3. The declarant should prepare one photocopy of his/her own identification document and one of his/her spouse's or cohabiting partner's to facilitate identity confirmation. 4. The declarant should not seal any part of the declaration. The declaration should be initialled and sealed in the appropriate envelopes by the staff in charge in the presence of the declarant. 5. If the declaration is to be sent by mail, all the parts and the respective envelopes should be sealed together in one envelope prepared by the declarant, clearly marked as "Confidential", stating the identification of the declarant and mentioning "declaration enclosed". The declaration should be sent, by registered mail with return receipt requested, before the expiration of the term, to the President of the Court of Final Appeal or the Commissioner Against Corruption. If the declarant does not enclose an envelope with sufficient postage for returning the duplicate, or the envelope is unfit to safeguard its security and confidentiality, the depositary entity will seal and file the duplicate together with his/her declaration. The declarant may collect it anytime in person.

Should you have any inquiries, please contact the Declaration of Assets and Interests Division during office hours (telephone no.: 8395 3321) or visit the section "Related Law" on the website of the CCAC (www.ccac.org.mo). You may also browse Law no. 11/2003 (Legal Regime of Declaration of Assets and Interests) as amended by Law no. 1/2013 on the website.Samples of a filled declaration are available in the service or institution where the declarant serves. The "Sample for filling in the declaration" is available at the CCAC website (www.ccac.org.mo).